Crimes against the elderly population are increasing at an alarming rate. Among these crimes, the financial exploitation of older adults is the most common.1 However, financial crimes are often very complex, involving numerous transactions in multiple accounts spread over months or years. Perpetrators of these crimes recognize that many factors—including cognitive decline and health issues, the shift from pensions to self-managed retirement accounts, and the rapid growth of the elderly population—make older adults particularly vulnerable.2 Recognizing the severity of the problem, the U.S. Department of Justice’s Elder Justice Initiative provided funding to the IACP to develop a tool to help investigators and prosecutors investigate financial crimes targeting older adults.

Financial investigations often require detailed examination of bank records that could contain hundreds of individual transactions from multiple checking, credit card, savings, and investment accounts. Compounding the problem is the lack of a uniform format of records provided to law enforcement by financial institutions; they are often paper records or PDFs that cannot be easily imported into a spreadsheet or other tracking tool. The IACP project team spoke with investigators from around the United States and found that the most commonly cited hurdle in the investigation of financial exploitation was the entry of data from the bank statements and other financial documents.

Named for protecting the most vulnerable segment of the population, the Senior Abuse Financial Tracking and Accounting (SAFTA) tool, is designed to

help detectives, crime analysts, and prosecutors conduct financial exploitation investigations. Considering the wide range of expertise that agencies and investigators might or might not have in conducting financial exploitation cases, the SAFTA tool was carefully designed to provide detailed data analysis while also being easy to use. The following elements contribute to the usability of the tool:

User-friendly interface. The SAFTA tool is a Microsoft Excel–based application with graphical interfaces that provide an intuitive step-by-step process for investigators to build case details for each financial account being reviewed. This allows most agencies to utilize the file without the need for new software. No prior Excel knowledge is needed, since users are not required to enter data into individual cells or validate formulas; instead, the tool uses dialog boxes for data entry. The user can choose to build high-level summary activity for each financial account or enter individual transaction details, if a closer examination is required.

User-friendly interface. The SAFTA tool is a Microsoft Excel–based application with graphical interfaces that provide an intuitive step-by-step process for investigators to build case details for each financial account being reviewed. This allows most agencies to utilize the file without the need for new software. No prior Excel knowledge is needed, since users are not required to enter data into individual cells or validate formulas; instead, the tool uses dialog boxes for data entry. The user can choose to build high-level summary activity for each financial account or enter individual transaction details, if a closer examination is required.

Fully customizable. Recognizing that each jurisdiction may require its own  specific data fields or preferred nomenclature, a built-in administration (admin) page is available for the user to modify the tool. From the admin page, users can edit existing fields or add new fields. IACP recommends that agencies create a standard SAFTA tool template that meets their requirements for use in their elder abuse financial investigations.

specific data fields or preferred nomenclature, a built-in administration (admin) page is available for the user to modify the tool. From the admin page, users can edit existing fields or add new fields. IACP recommends that agencies create a standard SAFTA tool template that meets their requirements for use in their elder abuse financial investigations.

Simplified data. After an investigator has completed data entry for the financial accounts under scrutiny, activity summary and account detail sheets can be viewed to identify suspicious patterns in the victim’s typical transaction history. Additionally, the investigator can use the “Pivot Table” tab to summarize transaction data by various characteristics such as dates, payees, or amounts to reveal sums and patterns that are key to the investigation. The pivot table will save investigators time and increase the likelihood that suspicious activity and trends will be identified by eliminating the need to manually compare dozens of paper financial documents across multiple accounts.

summarize transaction data by various characteristics such as dates, payees, or amounts to reveal sums and patterns that are key to the investigation. The pivot table will save investigators time and increase the likelihood that suspicious activity and trends will be identified by eliminating the need to manually compare dozens of paper financial documents across multiple accounts.

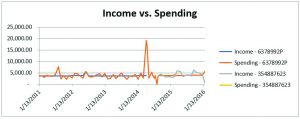

Graph dashboard. Creating graphs within the SAFTA tool to visually interpret the financial data is extremely easy. Users can create their own line, bar, or pie  charts based on data contained within the activity summary and account detail sheets, or they can use one of several pre-generated graph templates. Once created, charts can be refreshed to reflect new data that have been entered. These visualizations of trends in financial account deposits, withdrawals, and total balances can be shared with prosecutors to help move cases forward.

charts based on data contained within the activity summary and account detail sheets, or they can use one of several pre-generated graph templates. Once created, charts can be refreshed to reflect new data that have been entered. These visualizations of trends in financial account deposits, withdrawals, and total balances can be shared with prosecutors to help move cases forward.

Auditing and security. Ensuring the integrity of an investigative process is paramount in any criminal case. The SAFTA tool offers users several layers

of accountability and security. First, the SAFTA tool is password protected and has two different user levels: (1) administrators, who have complete access to enter data, assign other users, and modify templates; and (2) normal users who can update case details and enter financial records. Second, the tool creates auditing trails detailing the date, time, and user for any changes made to the file.

The SAFTA tool can provide law enforcement a starting point for conducting these potentially complicated investigations, leading to greater prosecution and closure rates and ultimately reducing the devastating effects financial crime can have on vulnerable community members. In addition, the IACP designed a guide for conducting elder financial exploitation investigations with resources such as sample subpoenas and search warrants. For more information on identifying and responding to elder abuse or to download the SAFTA tool, visit IACP’s elder abuse webpage.

Notes:

1Janey C. Peterson et al., “Financial Exploitation of Older Adults: A Population-Based Prevalence Study,” Journal of General Internal Medicine 29, no. 12 (2014): 1615–1623.

2Stephen Deane, Elder Financial Exploitation: Why It Is a Concern, What Regulators Are Doing About It, and Looking Ahead (Washington, DC: U.S. Securities and Exchange Commission, Office of the Investor Advocate, 2018).